Nvidia, albeit briefly, joined a small band of companies valued over $1 trillion, a mantle previously occupied by four consumer-facing tech companies – Apple, Google, Microsoft and Amazon.

By Business Briefs

The rise of Nvidia has been fuelled by the artificial intelligence boom that the growing use of generative AI has set off.

How Nvidia Went from a Crypto Stock to an AI Stock?

The semiconductor industry has been going through a tough time over the last two years.

The increased electronic demand during the pandemic, combined with supply-chain issues, caused the prices and sales volumes of chips to rise rapidly.

At the same time, companies like Nvidia benefitted from the increasing demand for chips from the cryptocurrency sector. Nvidia soon became a favourite among investors since it benefitted from the increased crypto-mining activities. The company even created a chip that was specifically suited to the mining of crypto.

However, as the economy began slowing down, the electronics and crypto boom ended.

The slowdown hit chip companies, whose valuations analysts felt were too stretched.

Nvidia saw its stock price more than halve between November 2021 and November 2022. In the same period, Wall Street’s 2024 revenue consensus for the company dropped from around $ 36.6 billion to $ 30 billion.

The sharp cut went even lower in February 2023 to $ 29.3 billion. The revenue projections point to pessimism surrounding the stock as recently as February 2023.

However, the pessimism turned into exuberance on 25 May when the company guidance for revenue was nearly 50 per cent higher. The company’s guidance moved Wall Street’s consensus estimates from $ 30 billion to $ 42 billion within a day.

It is extremely rare for a company to give such sharp upside guidance, especially for a company of Nvidia’s size. The market’s sharp reaction stemmed from the company’s expectations being far from consensus estimates.

Nvidia’s confidence probably stems from its dominant position in AI space and the sharp rise in corporations and individuals globally adopting AI.

According to Omdia, Nvidia has a nearly 80 per cent market share in the AI processor market. According to CB Insights, the company has a 95 per cent share in the graphic processor unit (GPUs) market for machine learning.

According to a UBS research report, Nvidia’s 10,000 GPUs power ChatGPT’s supercomputer. A GPU could cost anywhere between $ 10,000 to $38,000, according to reports, and with companies buying tens of thousands of these, revenues are bound to go significantly higher.

With rapidly increasing demand and no comparable competitor, Nvidia is confident of achieving the guidance it has provided investors with.

Can Anyone Compete With Nvidia?

Nvidia develops and markets computer chips and devices and is best known as the dominant supplier of standalone graphics processing units, or GPUs, for personal computers and datacenters, which are used widely for artificial intelligence processing and graphics processing. Nvidia also develops and markets products for advanced networking, datacenter central processing units, and computer-assisted driving.

Intel’s and AMD’s inability to build products suitable for the AI sector is one of the reasons why Nvidia has gained dominance in the space. Nvidia’s research team had been working on these chips since the 2000s, giving it an edge over other companies.

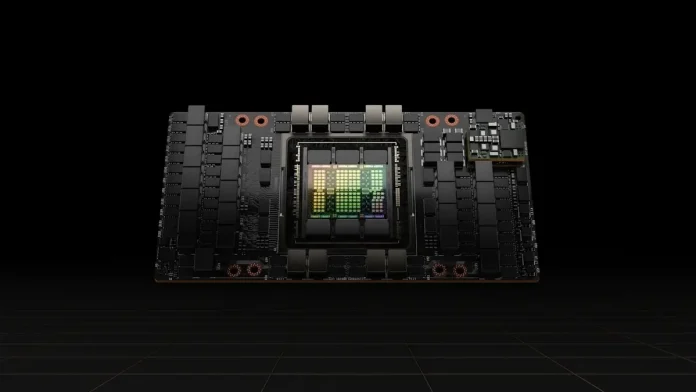

Jensen Huang, Nvidia’s chief executive described H100, a powerful process build by his company, as “the world’s first computer [chip] designed for generative AI”— artificial intelligence systems that can quickly create humanlike text, images and content.

AMD’s GPUs are generally considered less efficient than Nvidia’s, while Intel has been troubled with other issues in its core businesses. However, these companies are stepping up their game.

AMD is looking to come out with MI300, a combination of CPU and GPU. At the same time, clients who rely on Nvidia for chips are now looking to create their own chips.

Alphabet, Microsoft, Meta, and Amazon have been working on their own chips for applications. All of these players have deep pockets and are focused on producing chips that fit in with their own niche requirements.

Can AI Boom Pull the Semiconductor Sector Out of Misery?

The rise of AI could cut some of the slack in the semiconductor sector.

The AI boom would also require memory chips, DRAM and NAND chips since a chip produced by Nvidia cannot operate alone.

Since each AI chip would be accompanied by a number of the previously mentioned chips, it would help bring back demand for some of these companies.

The boom would also help Taiwan, which houses the largest chip manufacturers. The country has seen its economy slip into a recession as export demand fell significantly.

If AI turns out to be a sustainable trend and not a brief fad like crypto, it could help drive longer-term earnings for players in the semiconductor space.

Unlike a short-term fad like crypto mining chips, the demand for AI chips is not driven by temporary factors like liquidity but by a structural shift. Companies, both large and small, are exploring AI to find where it fits within their ecosystem.

This article first appeared in www.swarajyamag.com and it belongs to them.